Child Tax Credit 2025 Irs Form – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . People filing in 2025 are filing for the year 2023. The Child Tax Credit offers support to as many as 48 million applying American adults who need an extra bit of help with raising their children so .

Child Tax Credit 2025 Irs Form

Source : www.kvguruji.com

Understanding IRS Form 8812 for Child Tax Credit in 2023 and 2025

Source : www.woodtv.com

IRS releases 2025 tax brackets; What is new standard deduction

Source : www.al.com

Child Tax Credit 2025: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

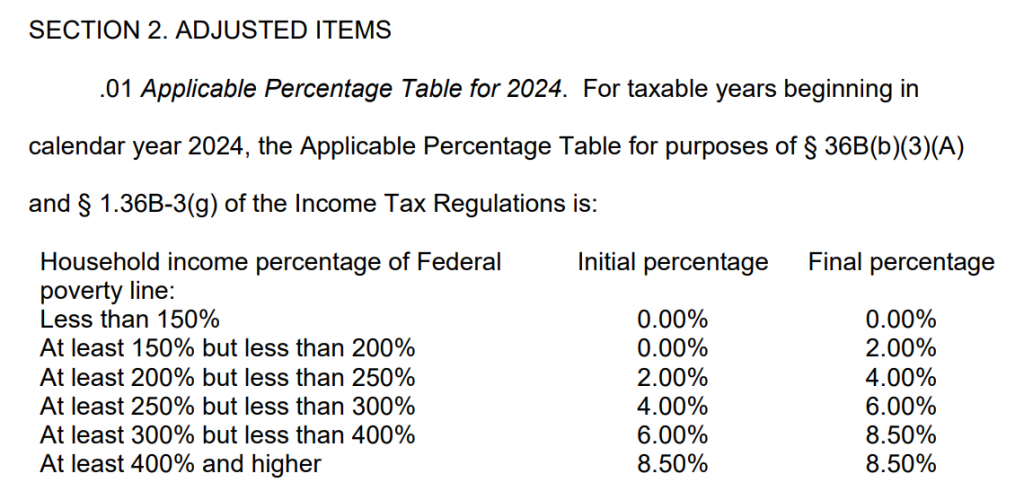

IRS Issues Table for Calculating Premium Tax Credit for 2025 CPA

Source : www.cpapracticeadvisor.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

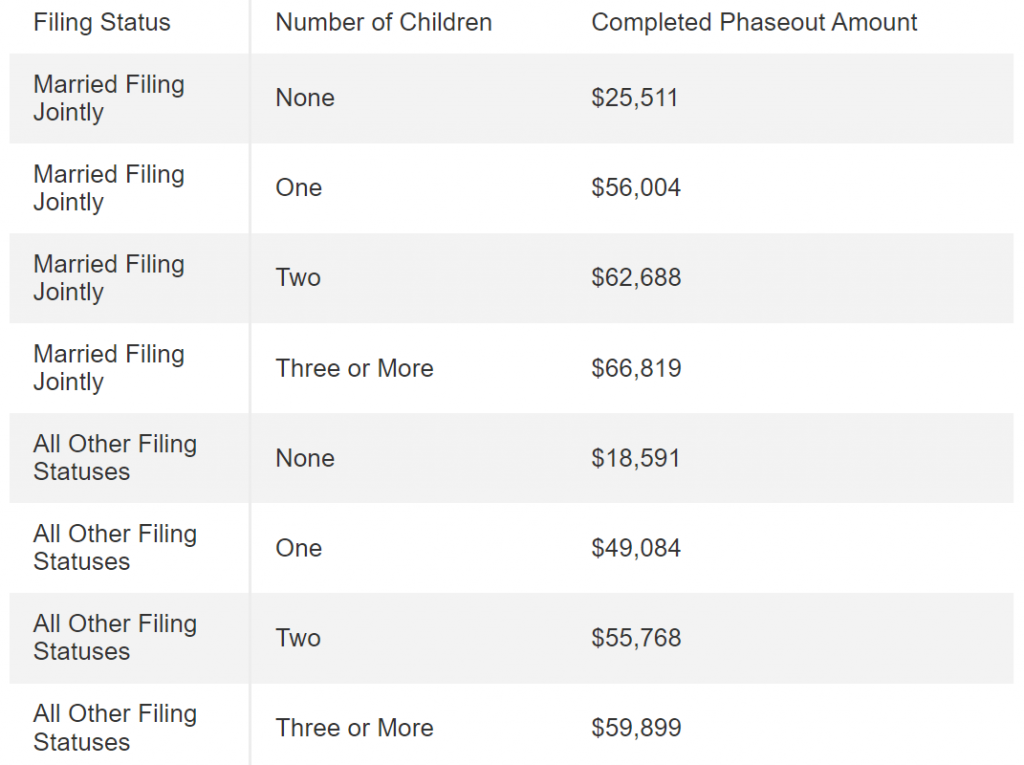

Here Are the 2025 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

USA Child Tax Credit 2025 Increase From $1600 To $2000? Apply

Source : cwccareers.in

Here Are the 2025 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

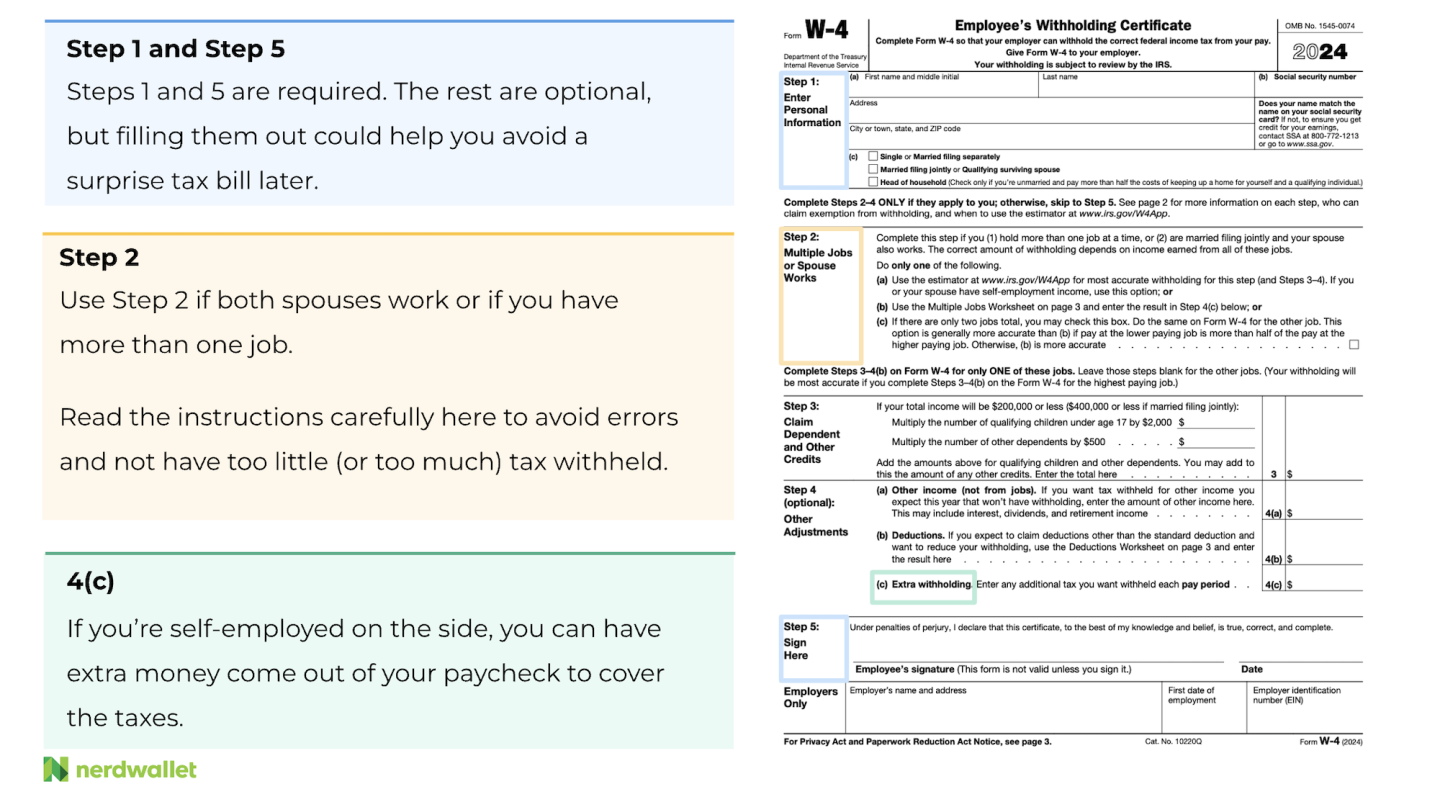

W 4: Guide to the 2025 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2025 Irs Form IRS Child Tax Credit 2025: Credit Amount, Payment Schedule, Tax Return: This year, the what-if involves the possible expansion of the child tax credit, which likely would be retroactive At that time, Hetherwick stated, the IRS quickly moved to update the tax form to . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .